Previous Website News Article Postings

Jump to: LCPR Updates MN News National News Secure Choice News & Publications

LCPR News

● Mandatory Reporting Requirements

Minnesota statutes and session laws enacted in 2025 require certain entities to provide reports to the Legislative Commission on Pensions and Retirement on an annual basis. Specifically, in 2025, the Commission received reports for the first time on the Statewide Volunteer Firefighter Plan incentive program, the correction of operational errors by the public pension systems, and the employees who elected a transfer from the Minnesota State Individual Retirement Account Plan to the Teachers Retirement Association. All reports are available on the LCPR website on the page titled Mandatory Reporting to the LCPR.

● LCPR Work Groups for 2024 Interim

During the 2024 interim, LCPR staff convened the meetings of two work groups, each of which was required to recommend legislation to address a pension policy issue that the Commission discussed during the 2024 legislative session:

- The Work Group on MSRS Correctional Plan Eligibility, required by Laws 2024, Ch. 102, Art. 5, Sec. 14, must recommend legislation to correct deficiencies in the process for adding positions for coverage by the MSRS Correctional Plan. Meetings of this work group were held on July 29, August 21, September 17, October 2, and October 24, 2024. Agendas and materials for work group meetings can be found at www.lcpr.mn.gov/WorkGroups/MSRSCorrectionalWG.htm.

- The Work Group on MSRS Correctional Plan Eligibility submitted its recommendations to the Commission on March 20, 2025, and the recommendations and proposed legislation are available on the meeting page.

- The Work Group on Amortization, required by Laws 2024, Ch. 102, Art. 8, Sec. 13, must recommend legislation to update statutes dictating amortization periods to "conform to actuarial best practices for amortizing liabilities." Meetings of this work group were held on July 30, September 4, and October 3, 2024, and January 9, 2025. Agendas and materials for work group meetings can be found at www.lcpr.mn.gov/WorkGroups/AmortizationWG.htm.

- The Work Group on Amortization submitted its report to the Commission on March 20, 2025, and the report is available through the Legislative Reference Library.

- The Work Group on Amortization submitted its report to the Commission on March 20, 2025, and the report is available through the Legislative Reference Library.

● Governor signs 2024 Pension and Retirement Policy and Supplemental Budget Bill.

The Governor signed the 2024 Pension and Retirement Policy and Supplemental Budget Bill (HF5040-Her/Frentz, 4th Engrossment) on May 15, 2024, as Laws 2024, Chapter 102. Find the history of action on the bill and summaries of the various versions of the bill on the 2024 Pension & Retirement Bill page.

- General summary of the bill as enacted

- Section-by-section summary of the bill as enacted

- List of the source bills in the bill as enacted

● LCPR Staff Research Brief: Sharing of Public vs. Private Personnel Data

To respond to requests for data or for other purposes, staff at the public pension plans may request information about their plan’s members from the member’s employer. However, the question then arises: What employee information may be shared with the pension plans? LCPR staff researched the issue, and the short answer is that information that is considered public under Minn. Stat. § 13.43 may be shared with the pension plans. See the LCPR Memo on Public vs. Private Personnel Data for more information.

● Supplemental State Aid Work Group Report submitted to the LCPR.

The State Auditor convened a work group to discuss and articulate to the LCPR options for changing the method of allocating police and firefighter retirement supplemental state aid. The work group and report were mandated under Minnesota Laws 2021, Ch. 22, Art. 9, Sec. 2.

● 2022 Session Summary of pension and retirement legislation is now available.

The summary, prepared by Commission staff, covers the actions relating to pensions and retirement by the Legislature and the Legislative Commission on Pensions and Retirement that occurred during the 2022 legislative session. Most of the pension legislation enacted during the 2022 legislative session was enacted as part of the 2022 omnibus pension and retirement bill, which was passed as Laws 2022, Chapter 65, but other enacted legislation indirectly related to pensions and retirement topics and non-legislative actions taken by the Commission are also included in the summary.

● Van Iwaarden Associates to continue as Commission Actuary for two more years

The Commission, acting through its Executive Committee, has approved the extension of the Commission's contract with local actuarial firm, Van Iwaarden Associates (VIA), for another two years. The contract was due to expire on January 21, 2023. Under the terms of the extension, VIA will perform actuarial audits of St. Paul Teachers Retirement Fund Association and the MSRS and PERA Correctional Plans in 2023 and the Police and Fire Plan and State Patrol Plan in 2024. VIA will also review the quadrennial experience studies for the MSRS and PERA General Plans and TRA in 2024.

● New webpage for required filings added to lcpr.mn.gov website

The Commission has added a new webpage, called "Mandatory Reporting to the LCPR", to its website, at the link under "Quick Links" on the right side of the home page. Legislators, staff, and the public will be able to access annual filings required by statute. So far, filings that are now available for viewing are:

- by the City of St. Paul and the St. Paul Public Schools, regarding the number of trades employees participating in both a multiemployer plan and PERA, and

- by 403(b) and 457(b) plan administrators or custodians, regarding investment fees and rates of return for these plans.

Commission staff hope to add access to the "Investment Business Recipient Disclosure Forms" that are required to be filed annually by all volunteer fire relief associations that offer a retirement plan in the months to come.

● Governor signs 2022 Pension and Retirement Omnibus Policy Bill

The Governor signed the Commission's omnibus policy bill on May 22, 2022. Find links to Chapter 65 and summaries of the bill as passed on the 2022 Pension and Retirement Bills page.

● 911 Telecommunicator Pension Benefits Working Group Report submitted to the LCPR

Laws 2021, Chapter 22, Article 9, Section 1, required the Commission to convene a working group for the purpose of studying 911 telecommunicator pension benefits. You can find information on the Working Group (meetings, agendas, etc.) on the 911 Telecommunicators Pension Benefits Working Group page.

● 2020 Actuarial Valuations.

The annual actuarial valuation reports for the MSRS and PERA plans, TRA, and St. Paul Teachers are now available and are posted on the Actuarial Valuations page under the Actuarial & Financial Reporting drop-down menu above.

● A meeting of the PERA Statewide Volunteer Firefighter Plan Work Group on Fire State Aid was held Tuesday, July 7, 1:30-3:30 PM.

This informal work group met for the first time on Thursday, June 18, to begin discussions on the topic of diverting a portion of the fire state aid that would otherwise fund retirement benefits for volunteer firefighters in the PERA SVF Plan to affiliated municipalities, where the fire department employs both career and volunteer firefighters. Click here for the agenda and materials from that meeting.

● 2020 Pension & Retirement Bill signed by the Governor on May 27

● LCPR appoints new Commission actuary

At its meeting on December 18, 2019, the Commission voted unanimously to approve Van Iwaarden Associates as the Commission's new actuary, effective as soon as a services agreement can be finalized and signed. Read more...

● The 2018 Omnibus Pension and Retirement Bill becomes law upon signing by the Governor on May 31

On Thursday, May 31, Governor Dayton signed S.F. 2620, which had been unanimously approved by both the House of Representatives and the Senate during the 2018 legislative session. The new law makes changes to pension benefits, increases employer and employee contributions, and appropriates funding to help pay for the increases. All the state's public pension plans are impacted by the bill, including volunteer firefighter relief association plans. The new law is Chapter 211 of the Minnesota 2018 session laws. For summaries and actuarial and fiscal analyses, see:

- Summary

- Table of Contents

- Section-by-Section Summary

- List of Source Bills

- Actuarial Analysis of the Impact of the Bill Over a 30-Year Period, prepared by the pension funds

- Funded Status of the Retirement Plans as of 6/30/2018

- Appropriation Tracking (revised), prepared by Senate Fiscal Staff

● Impact of the 2018 Omnibus Pension Bill by retirement system:

MSRS Plans PERA Plans TRA SPTRFA

● LCPR Executive Director publishes in The NAPPA Report: Public Pension Plan Reforms and IRS Pick-Up Requirements

The federal law requirements that allow mandatory employee contributions to public pension plans may limit the alternatives available for increasing contributions and reforming pension benefits to reduce liabilities. Ms. Lenczewski describes the requirements and their impact on reforms and suggests solutions...

● Assessing the health of Minnesota's Pension Plans (Capitol Report)

The current chair of the LCPR, Senator Julie Rosen, R-Vernon Center, and a former chair, Senator Sandra Pappas, DFL-St. Paul, join Capitol Report moderator Shannon Loehrke to discuss the health of the state's pension plans, which provide pensions to state, county, municipal, school district, and other public employees.

Watch Sen. Rosen's interview (YouTube) Watch Sen. Pappas' interview (YouTube)

Minnesota News

● Jill Schurtz, CIO and Executive Director of the MN State Board of Investment, is featured in a two-part interview published in Pensions & Investments on September 4, and September 5, 2024.

In the first installment of Pensions & Investments’ latest Face to Face interview, Schurtz discusses new initiatives, particularly the board’s recent adoption of a climate roadmap aimed at capturing returns from the energy transition, investing in private markets and how she’s structured the team.

In this second installment of a Face to Face interview with Schurtz, executive director and CIO of the $146 billion Minnesota State Board of Investment, she talks about lessons learned, her career, the importance of hiring and developing a team, and the need for diverse perspectives.

● Chris Farrell on the advantages of auto-IRA programs, including Minnesota’s Secure Choice program (Star Tribune)

"Minnesota’s saving program should become available next year for those workers without an employer retirement plan." Read more...

● State Board of Investment reports 12.3% investment return for the Combined Funds for fiscal year 2024

"Minnesota State Board of Investment, St. Paul, on Aug. 14 reported $93.7 billion in defined benefit assets as of June 30, the close of SBI’s fiscal year, buoyed by a net investment gain of 12.3%."

"The board’s latest return topped its composite benchmark by almost 50 basis points, according to a performance report on the SBI website." Read more...

● Revenue explains new subtraction for public pension income (MN DOR)

The Minnesota Department of Revenue published a document on Public Pension Subtraction, last updated May 15, 2025. Information is available on the pension plans that qualify, income limitations for the subtraction, determining benefits for the subtraction, and determining eligibility for benefits if you are receiving Social Security benefits. Read more...

● Post-traumatic stress disorder study

During the 2023 legislative session, the Minnesota Legislature passed House File 2988, which requires the Department of Labor (DLI) to conduct a comprehensive study about work-related post-traumatic stress disorder (PTSD) in the workers' compensation system. It will be completed by Aug. 1, 2025. Read more...

● Minnesota teachers fundraise for forensic audit of TRA (Minnesota Center for Fiscal Excellence, blog post, 4/2024)

"Minnesota educators are concerned that the Teacher Retirement Association (TRA), the body that manages the statewide educator pension system, has mishandled employee contributions."

"Our prediction right now is that this is going to turn up absolute bupkis, and that teachers contributing to this fund are wasting their money….the idea that state pension asset management is a quagmire of inexperience, excessive and hidden fees, conflicts of interest, political shenanigans, and general asset management malfeasance – the types of things that seem to be this attorney’s specialty --is ridiculous." Read more...

● State Board of Investment reports a one-year 11.7% investment return for the Combined Funds as of September 30, 2023.

The Combined Funds consist of the assets of the statewide retirement systems, including the pension plans administered by the Public Employees Retirement Association (PERA), the Teachers Retirement Association (TRA), and the Minnesota State Retirement System (MSRS). These assets fund pensions and retirement accounts for active and retired public employees. For more information, see the chart at the bottom of this page and the SBI’s Combined Funds Summary.

● Study report: Adequacy of Disability Benefits for Minnesota Police Officers.

During the 2022 session, the Minnesota Legislature passed Senate File 1547, a bill requiring the Department of Labor and Industry (DLI) to complete a study of police disability benefit adequacy with the assistance of the Public Employees Retirement Association (PERA). See the report...

In June 2023, the DLI issued an addendum to the study report that summarizes interviews conducted by DLI's research team of injured police officers and their families. The summaries supplement the findings in the study report with perspectives from the direct recipients of workers' compensation and PERA disability benefits.

● State Board of Investment selects Jill Schurtz as next Executive Director and Chief Investment Officer.

The Minnesota State Board of Investment voted on August 24, 2022, to select Jill Schurtz to serve as the Executive Director and Chief Investment Officer, to succeed Mansco Perry III, who is retiring in October. Ms. Schurtz has served as the CIO and Executive Director of the St. Paul Teachers Retirement Fund Association since 2014. The SBI, which oversees over $120 billion in state pension and other funds, consists of Governor Tim Walz, State Auditor Julie Blaha, Secretary of State Steve Simon, and Attorney General Keith Ellison. Read more...

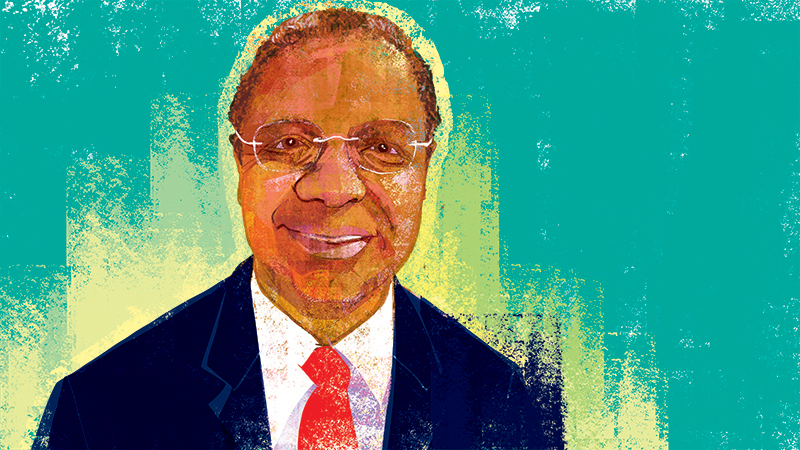

● Perry begins final lap at the Minnesota state agency that actually makes money (Star Tribune)

"Mansco Perry, a veteran of the Twin Cities financial scene, has led the State Board of Investment since 2013 and seen its assets nearly double in that time to $130 billion."

"Mansco Perry, who is nearing retirement after leading the Minnesota State Board of Investment (SBI) for nearly a decade, jokes that he has a vested interest in having a successor who is more skillful than him..." Read more...

● Minnesota reports 30.3% fiscal-year return for pension plans (Pensions & Investments)

"The combined defined benefit plans of the Minnesota State Board of Investment, St. Paul, returned 30.3% in the fiscal year ended June 30, the highest return since the 1983 fiscal year."

"The $89.9 billion combined fund topped its benchmark return of 28.8% in the 2021 fiscal year, fueled by the 45.3% return of the fund's domestic equity portfolio, the 37.8% return of the private markets portfolio and 36.8% from the international equity allocation..." Read more...

● Some well-deserved recognition for Mansco Perry, Executive Director of the State Board of Investment-(CIO Magazine)

"One of most highly regarded investment chiefs in public pensions, Perry continues to keep a cool head during turbulent times."

"Mansco Perry III is always working out a problem in his head. For years, the investment chief at the Minnesota State Board of Investment thought about what his team would do in the event of another downturn like the 2008 financial crisis." Read more...

● SBI to Divest from Coal Companies

The Minnesota State Board of Investment adopted a resolution at its meeting on May 29 to divest from coal companies that derive 25% or more of their revenues from the extraction or production of thermal coal. News stories on this development, one national, one local:

- Pensions & Investments (P&I): "Minnesota State Board votes to divest from thermal coal firms"

City Pages: "Minnesota quietly decides to divest from coal"

The SBI also resolved to adjust the public pension funds' asset allocation policy in response to the COVID-19 recession. Resolution

● Credit Rating Agencies Praise Omnibus Retirement Bill

Good news! Credit rating agencies Standard & Poor's and Fitch announced on July 24, 2019, that they are affirming Minnesota's AAA credit rating, the highest rating awarded by the analysts. The 12-page S&P report devotes an entire page to praise of the 2018 Omnibus Retirement Act, noting (S&P report, page 10):

"Notably, Minnesota has a history of making modest changes to its pension plans every few years through an omnibus retirement bill. Both the house and the senate passed the 2018 Omnibus Retirement Bill unanimously, indicating strong bipartisan support for improving the plans. The 2018 Bill allows that in the future, assumptions for payroll growth, salary increases, and mortality tables can be adjusted by updates to the...(LCPR) Standards for Actuarial Work. This should provide for some greater flexibility to adjust assumptions as appropriate to remain in line with the plan demographics, which we view as a positive for transparency and accuracy of reporting."

Both reports expressed concern that contribution rates are fixed in statute, rather than tied to the actuarially determined contribution (ADC) level. As a result, contributions have "consistently been below the actuarial levels," a "comparative credit weakness" (Fitch report, page 4).

Moody's issued its report on the State on July 25, 2019, giving the State its second highest rating (Aa1). Moody's echoed the concerns about our statutorily fixed contribution rates, stating: "In fiscal 2018, the state's pension contributions were about 70.4% of our "tread water" benchmark... This gap, which is among the largest in the state sector, exposes the state to the potential of a growing liability" (Moody's Report, page 6).

● Investment of public pension funds by the State Board of Investment in tobacco companies (Star Tribune, 8/4/2019)

- State of Minnesota has $297 million invested in tobacco firms. (8/4/2019) Two decades ago, Minnesota reached a landmark settlement with the industry and dumped much of its stock. But divestment is complicated.

- State investments include controversial copper-nickel mining companies. (8/1/2019) Fund invests in companies behind two controversial mining proposals in Minnesota.

● Editorial: Pension bill was 2018 bright spot for Minnesota Legislature (Star Tribune)

Shared sacrifice allowed for a win-win result for all concerned...

● Mark Dayton's last bill: Stability for 511,000 state workers' pensions (Pioneer Press, Christopher Magan)

Gov. Dayton held a signing ceremony that was "packed to the rafters...

● Editorial: Unanimously passed pension repair. Wow. (Pioneer Press)

Amid the dysfunction at the Capitol, Minnesotans should take note of a surprising example of good governing...

● Pension bill in limbo as legislative session progresses (Star Tribune, Jessie Van Berkel)

Teachers, firefighters and other public employees who plan to retire have a stake in a political showdown at the State Capitol. Minnesota's public employee pension funds have been strained as baby boomers retire and people live longer and would eventually run out of money to support retirees without changes to how they're funded...

● Minnesota House should act on clean pension bill (Star Tribune editorial)

Keep partisan poison pills away from a needed funding boost...a robust bill to prop up Minnesota's listing pension funds for public employees - including teachers and state and local government workers - won 66-0 approval in the state Senate. That bill now heads to the House, which ought to give it prompt no-nonsense attention. Why such enthusiasm for a pension bill? Reasons abound...

● Senate moves to fix Minnesota pension plans (Pioneer Press, Don Davis)

Many Minnesota government pension plans are paying out more than they are taking in. State Sen. Julie Rosen, R-Vernon Center, says that is troubling. Her colleagues agreed Monday when they unanimously approved her bill that increases funding going into the pension plans and slightly cuts some benefits...

● Moody's affirms credit rating for Minneapolis and revises outlook to negative..."

Moody's Investors Service affirms Minneapolis, MN's Aa1 general obligation unlimited tax (GOULT) rating. The city has $679 million of outstanding general obligation (GO) debt. The outlook has been revised to negative...

● Minnesota's systems seek legislative action on proposed reforms (MSRS/PERA/TRA, StarTribune)

The complexity of the systems makes it easy to underestimate their value and for opponents to use data selectively...

● Minnesota's public-pension system is in crisis (K. Crockett, StarTribune)

State's system is losing ground fast, relative to others. Here's why...

● How healthy are Minnesota's pensions? Depends on where you look (Pioneer Press)

Minnesota's pension plans have long had a reputation as safe and solid...

● Minnesota looking at moving to strategic asset allocation, returns 15.1% in fiscal year (P&I)

Minnesota State Board of Investment is considering restructuring its approximately $65 billion retirement investment portfolio into more strategically oriented categories...

● Minnesota CIO layers on risk-focused approach to investing (Pensions & Investments)

SBI's leader is taking a risk-focused approach to its investment strategy, adding a stand-alone U.S. Treasury allocation...

National News

● Research on Public Pension Retirement Security and Teachers’ Benefits (PEW)

Presentation by The Pew Charitable Trusts on practices of successful pension systems, retirement security metrics, and a comparison of Minnesota TRA pensions to teacher pensions in other states. Read more...

● NASRA publishes survey of employee contribution rates to public pension plans

The employee contribution rate for teachers in the Minnesota Teachers Retirement Association has been of interest lately as stakeholders look at possible benefit improvements. At 7.75%, do MN teachers contribute more than teachers in other states? Have a look at the recently published NASRA issue brief that surveys employee contribution rates for many public pension plans across the U.S., including teacher plans.

● Liz Weston: Why 403(b) retirement savings accounts might not be best for you

One more in the stream of less than favorable, even shocking, articles about the hidden costs of 403(b) arrangements in which nearly all MN public school teachers invest, even when they have available to them the low-fee MN Deferred Compensation Plan. Read More...

● NASRA publishes rate of return assumptions for public pension plans as of July 2023

The National Association of State Retirement Administrators (NASRA) recently published investment return assumptions by plan. Read More...

● Sagging Stocks Aren't the Only Threat to Pension Plans (Governing)

The National Conference of State Legislatures (NCSL) on market volatility and the state of the state of public pension funds (and the "smart moves" being made by certain funds to lower their investment ROR assumption).

"Last year, pension plans enjoyed big returns in the market, bringing their balances back to levels not seen since the Great Recession. They are still $1 trillion..." Read more...

● New Website for Nationwide Public Pension Plan Data

The Center for Retirement Research (CRR) at Boston College has just made available a newly updated "Public Plans Data" website. The website is a collaboration of the CRR, the Center for State and Local Government Excellence, and the National Association of State Retirement Administrators (NASRA).

This is a treasure trove of data on public pension plans and makes it easy to compare our public pension plans in Minnesota to other states' plans. Probably because some of the data dates back to 2014, the data for Minnesota still reports the Duluth Teachers Retirement Fund Association and the Minneapolis Employees Retirement Fund as if they are still separate plans, which they are not. Have a look: publicpensionplansdata.org

● Minnesota Governor Signs Pension Law to Cut Deficit (Bloomberg Law)

The new law is designed to slash the $17.1 billion pension funding deficit by about $3.4 billion...

● New Math Deals Minnesota's Pensions the Biggest Hit in the U.S. (Bloomberg)

Minnesota's debt to its workers' retirement system has soared by $33.4 billion, or $6,000 for every resident, courtesy of accounting rules.

Links to MN Plans' GASB Reports

● States face costly future if their citizens fail to save enough for retirement (NCSL)

Most Americans are not saving enough for retirement. The problem is especially severe among small-business employees, low-income workers and communities of color. On the brink of a national retirement security crisis, state lawmakers are stepping into the breach with a spectrum of innovative solutions...

Secure Choice News and Publications

Americans’ Views of State-Facilitated Retirement Programs (National Institute on Retirement Security, May 2024)

"..states are taking action to address the retirement challenges facing Americans by providing increased access to retirement plans. Since 2012, every state except Alabama has either enacted or introduced legislation that would establish state-facilitated retirement savings programs. These state-facilitated retirement programs offer a backstop for those working in jobs where employers do not offer retirement plans like a pension plan or 401(k) account." Read more...